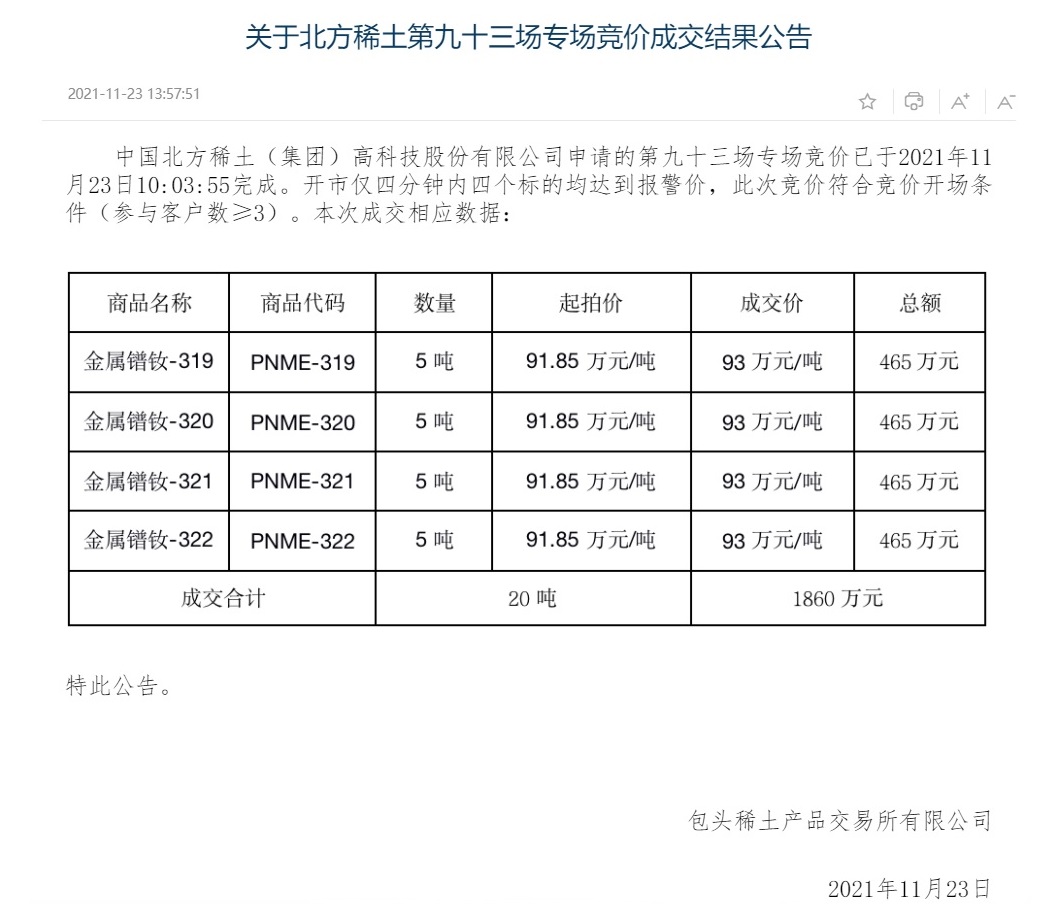

Since the second quarter of 2020, the price of rare earth has soared. The price of Pr-Nd alloy, the main rare earth material of sintered NdFeB magnets, has exceeded three times that of the second quarter of 2020, and Dy-Fe alloy Dysprosium Iron has the similar situation. Especially in the past month, rare earth prices have continued to rise, and the rare earth market has continued to be hot. Taking Praseodymium Neodymium oxide as an example, on November 26, the average spot price of Praseodymium Neodymium oxide was 855000 yuan / ton, up nearly 200000 yuan per ton in the past month, up 27.6%. The previous special auctions of North Rare Earth in the rare earth stock exchange were also traded at the alarm price, which can be seen from the hot degree of the rare earth market.

The rise of rare earth prices has little impact on China NdFeB magnet suppliers, but there is a certain lag in the transmission of costs to the downstream, which has a certain impact on the profit of Neodymium magnet manufacturers. Ningbo Horizon Magnetics also takes a variety of measures to deal with the fluctuation of rare earth prices.

Our product pricing model mainly refers to the cost plus model, but the specific pricing situation will comprehensively consider many factors, such as product performance, product processing complexity, packaging personalized requirements, etc. For high-end customers, compared with price factors, they often consider comprehensive factors such as product performance indicators, product consistency and delivery capacity. Due to the high proportion of rare earth metals in the sales cost, when the rare earth price fluctuates greatly, the company maintains timely communication with customers and adopts a dynamic and balanced price management mode to form an effective price transmission mechanism. Different customers have different price adjustment mechanisms, and the time required for price transmission to the downstream is also different. Bear the rising material cost for long-term strategic partner customers, stabilize the price for a long time, and adjust the price occasionally. There are yearly adjustment, quarterly adjustment, monthly adjustment and single discussion per order.

The company’s specific measures to deal with the fluctuation of rare earth raw materials include:

1. Our rare earth raw materials are mainly purchased from North Rare Earth and South Rare Earth according to the market price. We have established a good cooperative relationship with upstream suppliers and can ensure the supply in time.

2. Mainly adopt the production and sales mode of setting production by sales, and purchase rare earth raw materials in advance according to the orders on hand, so as to reduce the impact of price fluctuation of rare earth raw materials on the company’s business.

3. Price adjustment mechanism is usually included in the contract between the company and major customers. According to the price adjustment mechanism, we can adjust the unit price of our products according to the price adjustment cycle. The adjusted unit price generally refers to the market price of rare earth raw materials.

4. According to the price trend of upstream raw materials, a certain strategic reserve of raw materials will also be carried out, and an appropriate amount of rare earth raw materials will be purchased as safety inventory;

5. Increase the investment in technology research and development, optimize the product formula and adopt grain boundary infiltration technology to gradually reduce the proportion of heavy rare earth consumption of the same Neodymium magnet properties, reduce the production cost and improve the competitiveness.

Post time: Dec-01-2021