Japanese media reports that China is considering banning the export of specific rare earth magnet technologies to counter the technology export restrictions imposed by the United States on China.

A resource person said that due to China’s lagging position in advanced semiconductors, “they are likely to use rare earths as bargaining chips because they are a weakness for Japan and the United States.

The Ministry of Commerce and the Ministry of Science and Technology of China announced the draft list in December last year, which includes 43 amendments or supplements. The authorities have completed the process of publicly soliciting expert opinions, and it is expected that these revisions will take effect this year.

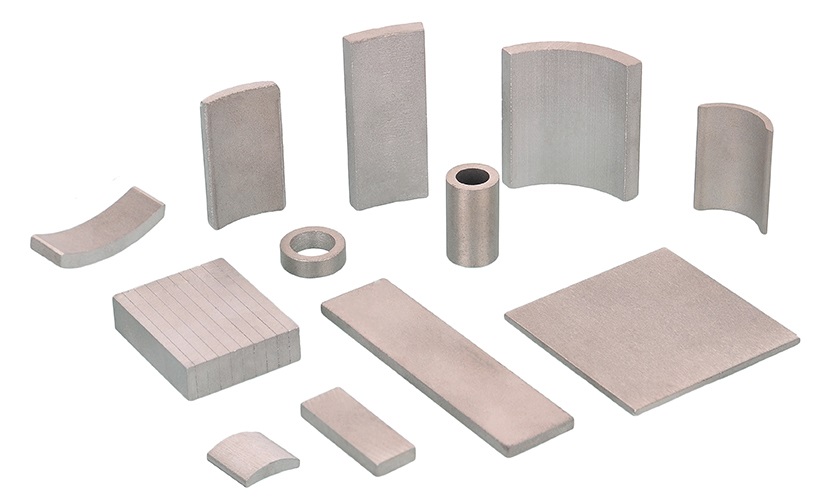

According to the solicitation of public opinion version, it is prohibited to export certain technologies that involve rare earths, integrated circuits, inorganic non-metallic materials, spacecraft, etc. The 11th item prohibits the export of rare earth extraction, processing, and utilization technologies. Specifically, there are four key points to consider: firstly, rare earth extraction and separation technology; The second is the production technology of rare earth metals and alloy materials; The third is the preparation technology of Samarium Cobalt magnet, Neodymium Iron Boron magnet, and Cerium magnets; The fourth is the preparation technology of rare earth calcium borate. Rare earth, as a precious non renewable resource, has a particularly significant strategic position. This revision may strengthen China’s export restrictions on rare earth products and technologies.

As is well known, China has strong dominance in the global rare earth industry. After the establishment of China Rare Earth Group in 2022, China’s control over rare earth exports has become stricter. This resource endowment is sufficient to determine the development direction of the global rare earth industry. But this is not the core advantage of China’s rare earth industry. What Western countries are truly afraid of is China’s unparalleled global rare earth refining, processing technology and capabilities.

The last revision of the list in China was in 2020. Afterwards, Washington established a rare earth supply chain in the United States. According to data from the United States Geological Survey (USGS), China’s share of global rare earth production has decreased from about 90% 10 years ago to about 70% last year.

High performance magnets have a wide range of applications, such as servo motors, industrial motors, high-performance motors, and electric vehicle motors. In 2010, China suspended exports of rare earths to Japan due to a sovereignty dispute over the Diaoyu Islands (also known as the Senkaku Islands in Japan). Japan specializes in producing high-performance magnets, while the United States produces products that use these high-performance magnets. This incident has raised concerns between the United States and Japan regarding economic security.

Japanese Chief Cabinet Secretary Hiroyi Matsuno stated at a press conference on April 5, 2023 that he is closely monitoring China’s export ban on high-efficiency rare earth magnet related technologies used in electric vehicles.

According to a report by Nikkei Asia on Thursday (April 6th), China’s official plan is to revise the technology export restriction list. The revised content will prohibit or restrict the export of technology for processing and refining rare earth elements, and it is also recommended to prohibit or restrict the export of alloy technology required for extracting high-performance magnets from rare earth elements.

Post time: Apr-07-2023