The first batch of rare earth mining and smelting quota were released in 2024, continuing the situation of continuous loose light rare earth mining quota and tight supply and demand of medium and heavy rare earths. It is worth noting that the first batch of rare earth index was issued more than a month earlier than the same batch of index last year, and less than two months before the third batch of rare earth index was issued in 2023.

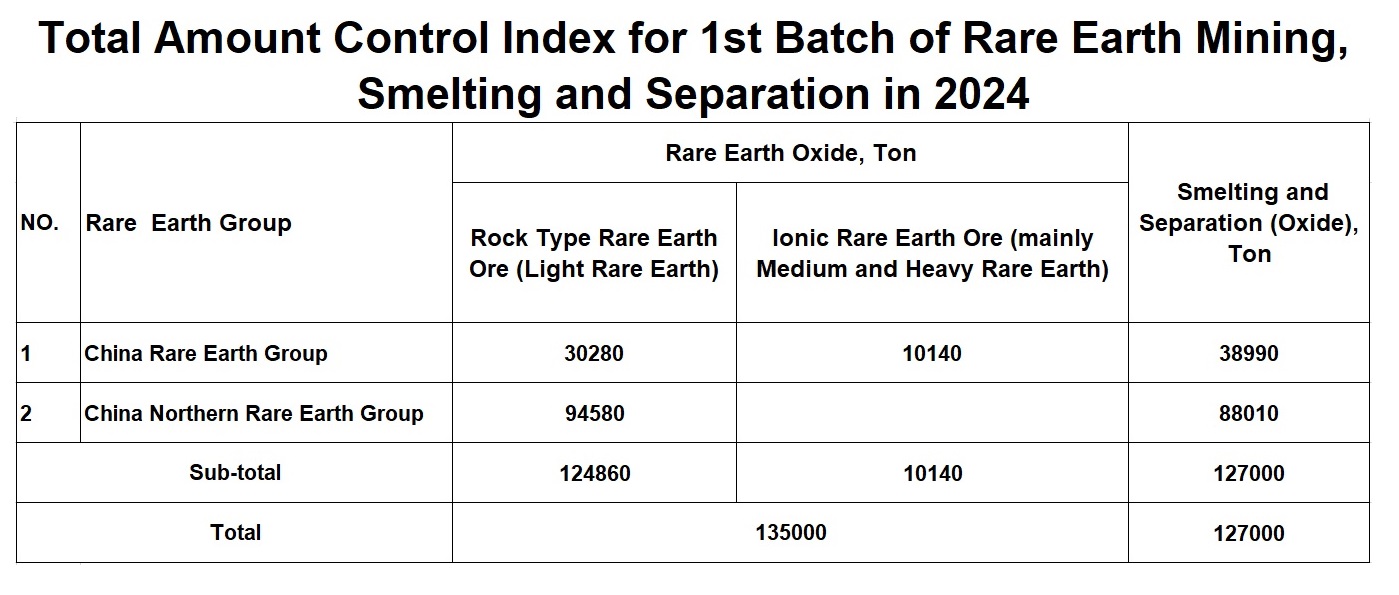

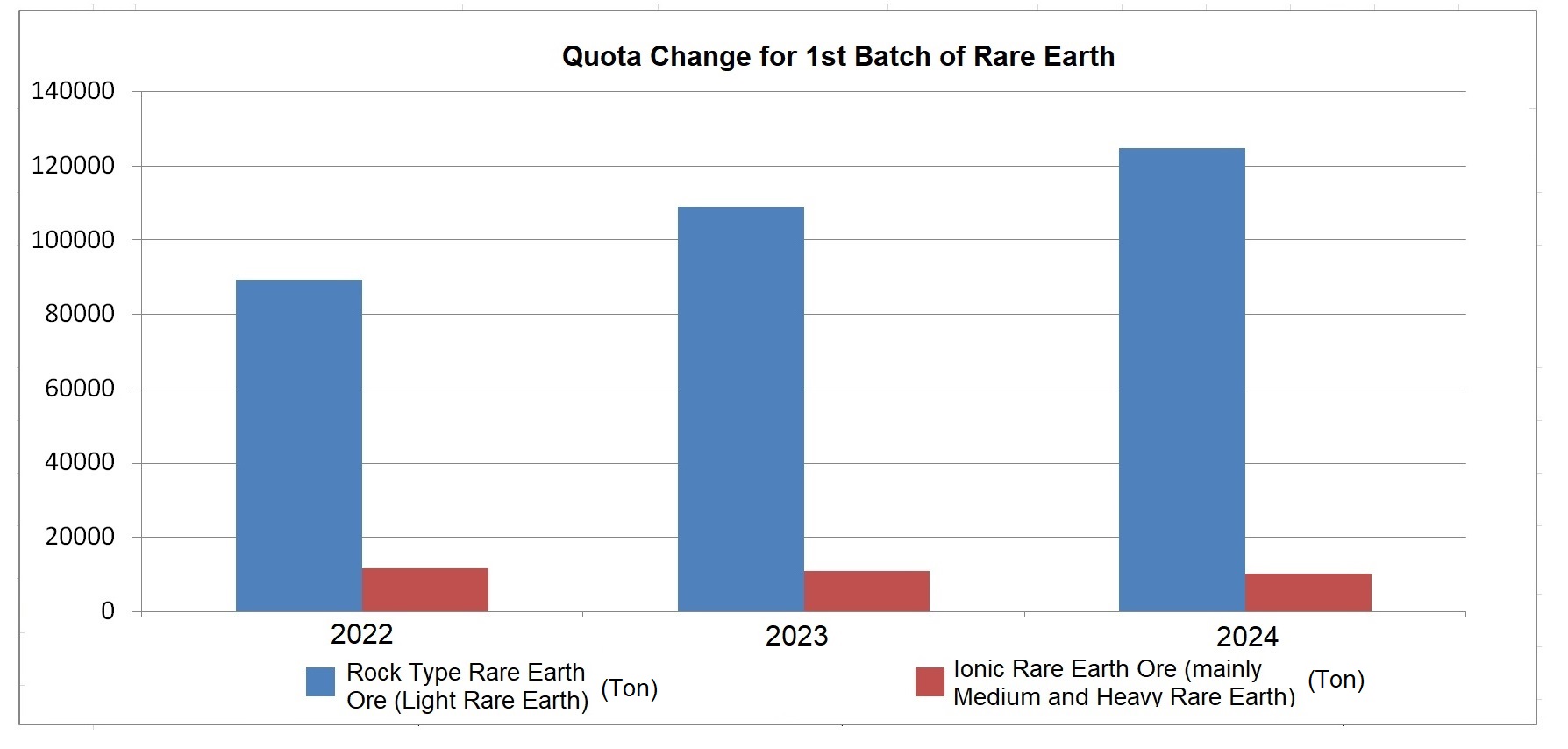

On the evening of February 6th, the Ministry of Industry and Information Technology and the Ministry of Natural Resources issued a notice on the total control quota for the first batch of rare earth mining, smelting and separation in 2024 (hereinafter referred to as the “Notice”). The Notice pointed out that the total control quota for the first batch of rare earth mining, smelting and separation in 2024 were 135000 tons and 127000 tons, respectively, an increase of 12.5% and 10.4% compared to the same batch in 2023, but the year-on-year growth rate has narrowed. In the first batch of rare earth mining indicators in 2024, the growth rate of light rare earth mining has significantly narrowed, while the indicators of medium and heavy rare earth mining have shown negative growth. According to the Notice, the first batch of light rare earth mining indicators this year is 124900 tons, an increase of 14.5% compared to the same batch last year, far lower than the growth rate of 22.11% in the same batch last year; In terms of medium and heavy rare earth mining, the first batch of medium and heavy rare earth indicators this year was 10100 tons, a decrease of 7.3% compared to the same batch last year.

From the above data, it can be seen that in recent years, the annual mining and smelting indicators of rare earths have increased continuously, mainly the quota of light rare earths have increased year by year, while the quota of medium and heavy rare earths have remained unchanged. The index of medium and heavy rare earths have not increased for many years, and have even decreased in the past two years. On the one hand, this is due to the use of pool leaching and heap leaching methods in the mining of ion type rare earths, which will pose a significant threat to the ecological environment of the mining area; On the other hand, China’s medium and heavy rare earth resources are scarce, and the country has not provided incremental mining for the protection of important strategic resources.

In addition, according to data from the General Administration of Customs, in 2023, China imported a total of 175852.5 tons of rare earth commodities, a year-on-year increase of 44.8%. In 2023, China imported 43856 tons of unidentified rare earth oxides, a year-on-year increase of 206%. In 2023, China’s mixed rare earth carbonate imports also increased significantly, with a cumulative import volume of 15109 tons, a year-on-year increase of up to 882%. From customs statistics, it can be seen that China’s imports of ionic rare earth minerals from Myanmar and other countries have significantly increased in 2023. Considering the relatively sufficient supply of ionic rare earth minerals, the subsequent increase in indicators of ionic rare earth minerals may be limited.

The allocation structure of the first batch of rare earth mining and smelting indicators has been adjusted this year, with only China Rare Earth Group and Northern Rare Earth Group remaining in the Notice, while Xiamen Tungsten and Guangdong Rare Earth Group are not included. Structurally, China Rare Earth Group is the only rare earth group with indicators for light rare earth mining and medium heavy rare earth mining. For medium and heavy rare earths, the tightening of indicators further highlights their scarcity and strategic position, while the continuous integration of the supply side will continue to optimize the industry landscape.

Industry experts say that the rare earth index is likely to continue to grow as downstream metal and magnetic material factories continue to expand production. However, it is expected that the growth rate of rare earth indicators will significantly slow down in the future. At present, there is sufficient supply of rare earth raw materials, but due to the low spot market prices, the profits of the mining end have been squeezed, and the holders have reached a point where they cannot continue to offer profits.

In 2024, the principle of total quantity control will remain unchanged on the supply side, while the demand side will benefit from rapid growth in the fields of new energy vehicles, wind power, and industrial robots. The supply-demand pattern may shift towards supply exceeding demand. It is expected that the global demand for Praseodymium Neodymium oxide will reach 97100 tons in 2024, an increase of 11000 tons year-on-year. The supply was 96300 tons, an increase of 3500 tons year-on-year; the supply-demand gap is -800 tons. At the same time, with the acceleration of the integration of China’s rare earth industry chain and the increase in industry concentration, the discourse power of rare earth groups in the industry chain and their ability to control prices are expected to increase, and the support for rare earth prices is expected to be strengthened. Permanent magnet materials are the most important and promising downstream application field for rare earths. The representative product of rare earth permanent magnet materials, high-performance Neodymium magnet, is mainly used in fields with high growth attributes such as new energy vehicles, wind turbines, and industrial robots. Experts predict that the global demand for high-performance Neodymium Iron Boron magnet will reach 183000 tons in 2024, a year-on-year increase of 13.8%.

Post time: Feb-19-2024